Facing a pile of gambling debt can be terrifying. The thought of repaying it all appears impossible, causing in stress and anxiety. But don't give up hope! There are practical actions you can take to formulate a realistic repayment plan and get your finances back on track.

- The primary step is to openly assess the full extent of your debt. Create a list of all your debts, including the sum owed and the APR.

- When you have a clear view of your debt, formulate a budget. Record your earnings and expenses to see where your money is going.

- Think about consolidating your debts into one loan with a lower interest rate. This can ease repayments and reduce you money over time.

Seek professional help from a financial advisor or credit counselor. They can give personalized advice on managing your debt and formulating a sustainable repayment plan.

Negotiate Your Way Out: Strategies for Gambling Debt Relief

Feeling the crushing weight of gambling debts? You're not alone. Many individuals find themselves in this difficult situation, but there are ways to claw your way back. One of the most effective tactics is negotiating with your creditors. Don't be afraid to contact and explain your position. A willing creditor might be ready to work with you on a payment schedule that matches your current situation.

- Initiate by gathering all your necessary financial documents.

- Tell the truth with your creditors about your money struggles.

- Propose a realistic payment scheme that you can manage.

- Investigate options like debt management.

- Remember that negotiation is a collaborative process.

While this method may not be a quick resolve, it can offer a path to economic stability. Remember, there are tools available to help you navigate this difficult phase. Don't let gambling debt dominate your life - take control and fight towards a brighter future.

Finding Freedom From Gambling Debt: Solutions That Work

Gambling debt can feel like an insurmountable burden, trapping you in a cycle of stress and despair. Though the path to freedom is achievable. It starts with acknowledging your problem and seeking help. Reaching out to trusted friends or family can provide invaluable support. Professional counselors specializing in gambling addiction can offer guidance and coping mechanisms. Financial consultants can help you create a budget, consolidate debt, and work towards financial stability. Remember, recovery is a journey, not a destination. Keep patient with yourself and celebrate your wins along the way.

- Consider Gamblers Anonymous or other support groups for connection and shared experiences.

- Reduce exposure to gambling triggers, such as casinos, online betting sites, and people who gamble heavily.

- Prioritize on healthy interests that bring you joy and fulfillment outside of gambling.

Regain Your Power: Managing Gambling Debt

Gambling might become a thrilling escape, but the consequences may quickly spiral out of control. If you're struggling with a gambling addiction, taking control is essential. A thoughtful debt management plan can help by providing strategies to manage your finances and regaining your sense of security.

- Seeking professional help from can provide invaluable guidance. They can help you understand your unique situation and develop a personalized plan that addresses your specific needs.

- Establishinga realistic budget is key to managing your finances. Track your income and expenses, find ways to reduce spending and prioritize funds towards paying off accumulated gambling losses.

- Sticking with your plan is necessary. It will likely involve patience, but the positive outcomes are significant. Remember, help is available and with dedication, you can rebuild your life.

Turning a Tide: Getting On Track After Gambling Losses

Gambling losses can be devastating, leaving you feeling lost. It's easy to fall into a rut of self-destructive thoughts and behaviors. But don't despair! There are steps you can take to turn the tide and get your life moving forward. First, it's crucial to understand that gambling is a serious issue. Don't try to minimize the problem. Seek assistance from friends, family, or a professional therapist. They can provide encouragement as you work through your struggles.

, Moreover, it's important to develop healthy coping mechanisms to deal with stress and emotions. Exercise can be helpful, as can practicing mindfulness or meditation. Remember, recovery is a journey, not a destination. Be patient with yourself, celebrate your wins, and don't hesitate to ask for help when you need it.

- Seek professional help: A therapist can provide guidance and support as you work through your gambling issues.Reach out to a support group: Connecting with others who understand what you're going through can be incredibly helpful. Develop healthy coping mechanisms: Find alternative ways to deal with stress and emotions, such as exercise or meditation.

Gambling Debt Doesn't Have to Define You: Steps to Recovery

Life can go off the rails when you find yourself in debt from gambling. It can feel overwhelming, like an insurmountable burden. But know this: you're not alone, and there is hope for recovery. Taking those first steps in the direction of healing might seem daunting, but it's crucial to remember that gambling debt doesn't have to control your future.

Start by acknowledging the problem. It's essential to take this step. Then, make a plan for your finances that focuses on paying off yourdebt. Consider talking to a therapist who specializes in gambling addiction. They can provide invaluable tools Essential Minerals for Menopause to help you navigate this challenge.

- Consider joining a support group for people who are struggling with gambling debt. Connecting with others who share similar experiences can be incredibly supportive.

- Learn healthy coping mechanisms that don't involve gambling. Focus on activities like exercise, meditation, spending time in the outdoors, or pursuing hobbies.

- Never forget that recovery is a journey, not a destination. There will be ups and downs along the way, but don't give up. Celebrate your successes and turn mistakes into lessons learned.

Mr. T Then & Now!

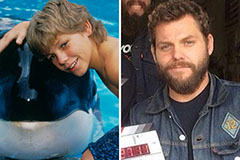

Mr. T Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now! Dolly Parton Then & Now!

Dolly Parton Then & Now!